Hi all,

I've been posting about this in the past and noticed more and more questions emerge around insurance for e-bikes. I'm the founder of Laka, a specialist bike insurer in the UK with a new business model. More about this below as this is not the reason for this post. Instead, I wanted to share a few thoughts on specialist vs home insurance for your bikes.

Home insurance: there are a few good providers out there, no doubt. However, I would always recommend doing the homework and really go through the fine print. We have seen policies that would only cover theft at home but not whilst you are out riding, damage to the bike being excluded, and even seen policies that only cover bikes in a 5 miles radius from home (really?!)... A high excess in your home insurance policy might eat up a good part of the claims settlement, and we have seen home insurance premiums going up after a claim for the bike.

Specialist insurance: there are again several providers in the market and their strengths are that cover was built solely for the purpose of covering bikes. Claims handlers will know how to take care of your precious bike and will allow for a much better experience in general. At Laka, 80% of our claims are for damage to the bike and accessories, the remainder for theft. In my opinion, the former is the bigger risk as it doesn't take much for parts to get damaged.

I've seen the cost of specialist bike insurance quoted as a hurdle. Of course, if you have a home insurance provider that covers the bike for theft at home only, that will pose a much lower risk than covering theft + damage whilst you are out and about. At Laka, 1 in 10 customers file a claim with us in a year, often for parts rather than the whole bike. With that, the lines between insurance and service play fade. The smallest claim settled was for a broken spoke as we don't have an excess. Admittingly this is a rare case though but illustrates the value (and by extension cost) of specialist cover. Having said that, I'm confident that our prices are quite competitive.

I would highly recommend doing your own research and ask some tough questions when it comes to the coverage of your bikes. Does the home insurer cover that spare battery? Will they replace "new for old" or will you need to accept a 3-year-old replacement a few years in? Are there any claims reviews publicly available?

I'm very happy to answer any questions you might have when it comes to bike insurance, but take it with a grain of salt as I am clearly biased ;-) If you are curious and want to give Laka a try, you will find a £25 discount code below.

Best, Tobi

+++

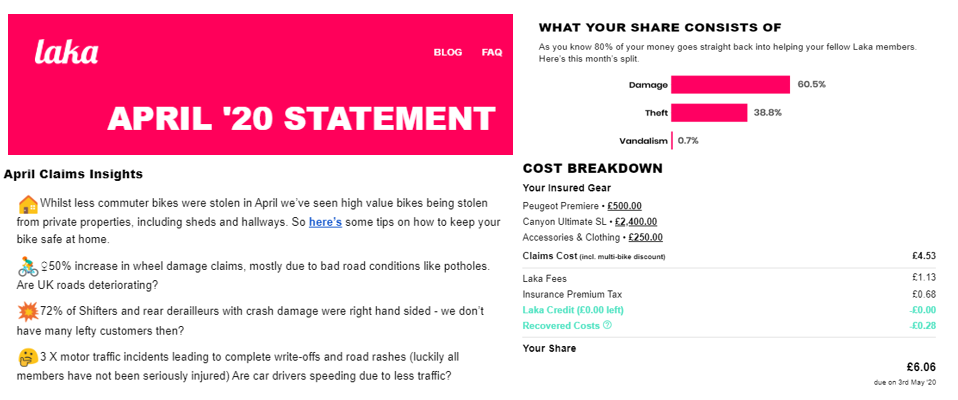

Laka no longer charges any premiums upfront. Instead, the Laka Community share the cost of claims at the end of a month based on the actual cost of claims incurred, and only up to a personal maximum. We show transparently what the Laka Community is paying for and offer monthly renewing policies (no more lock-in for a whole year); an illustrative billing e-mail from April below. Our claims handlers are former bike mechanics and live and breathe bikes. Check out or claims reviews if you like: link to Google Reviews. If you want to give us a try, use "EMTBForums" as your discount code for £25 off.

I've been posting about this in the past and noticed more and more questions emerge around insurance for e-bikes. I'm the founder of Laka, a specialist bike insurer in the UK with a new business model. More about this below as this is not the reason for this post. Instead, I wanted to share a few thoughts on specialist vs home insurance for your bikes.

Home insurance: there are a few good providers out there, no doubt. However, I would always recommend doing the homework and really go through the fine print. We have seen policies that would only cover theft at home but not whilst you are out riding, damage to the bike being excluded, and even seen policies that only cover bikes in a 5 miles radius from home (really?!)... A high excess in your home insurance policy might eat up a good part of the claims settlement, and we have seen home insurance premiums going up after a claim for the bike.

Specialist insurance: there are again several providers in the market and their strengths are that cover was built solely for the purpose of covering bikes. Claims handlers will know how to take care of your precious bike and will allow for a much better experience in general. At Laka, 80% of our claims are for damage to the bike and accessories, the remainder for theft. In my opinion, the former is the bigger risk as it doesn't take much for parts to get damaged.

I've seen the cost of specialist bike insurance quoted as a hurdle. Of course, if you have a home insurance provider that covers the bike for theft at home only, that will pose a much lower risk than covering theft + damage whilst you are out and about. At Laka, 1 in 10 customers file a claim with us in a year, often for parts rather than the whole bike. With that, the lines between insurance and service play fade. The smallest claim settled was for a broken spoke as we don't have an excess. Admittingly this is a rare case though but illustrates the value (and by extension cost) of specialist cover. Having said that, I'm confident that our prices are quite competitive.

I would highly recommend doing your own research and ask some tough questions when it comes to the coverage of your bikes. Does the home insurer cover that spare battery? Will they replace "new for old" or will you need to accept a 3-year-old replacement a few years in? Are there any claims reviews publicly available?

I'm very happy to answer any questions you might have when it comes to bike insurance, but take it with a grain of salt as I am clearly biased ;-) If you are curious and want to give Laka a try, you will find a £25 discount code below.

Best, Tobi

+++

Laka no longer charges any premiums upfront. Instead, the Laka Community share the cost of claims at the end of a month based on the actual cost of claims incurred, and only up to a personal maximum. We show transparently what the Laka Community is paying for and offer monthly renewing policies (no more lock-in for a whole year); an illustrative billing e-mail from April below. Our claims handlers are former bike mechanics and live and breathe bikes. Check out or claims reviews if you like: link to Google Reviews. If you want to give us a try, use "EMTBForums" as your discount code for £25 off.